Discover Prime Commercial Quality available for sale: Top Locations and Opportunities

In the present landscape of business realty, recognizing prime residential or commercial properties to buy calls for a critical strategy that considers not just traditional city centers but also emerging country hotspots. With moving demographics and evolving business demands, areas such as New York and Los Angeles stay pivotal, while lesser-known locations are getting traction as a result of populace growth and favorable economic problems. Comprehending the nuances of these markets, including key consider residential or commercial property choice, can substantially improve financial investment possibility. The question remains: which locations and possibilities are poised to produce the highest possible returns in this vibrant setting?

Existing Market Fads

The prime industrial property market is currently experiencing significant shifts driven by evolving economic conditions and changing customer actions. As companies adapt to crossbreed work versions, there is a discernible decrease in demand for standard workplace, motivating property managers to rethink their strategies. Versatile workspaces and co-working atmospheres are getting traction, attracting firms seeking cost-effective options while keeping worker involvement.

In addition, the surge of e-commerce has changed the retail landscape, resulting in an enhanced demand for logistics and warehousing centers. This fad underscores the requirement for properties that can fit last-mile delivery solutions, catering to a more instant customer base. Because of this, financiers are rerouting their emphasis in the direction of commercial assets, which are regarded as even more resistant in the current climate.

In addition, sustainability is coming to be a crucial factor to consider in residential or commercial property financial investments. Eco-friendly structure qualifications and energy-efficient layouts are not only drawing in tenants but are additionally boosting residential property worths. This expanding focus on environmental duty is improving the marketplace, as both financiers and occupants increasingly focus on lasting practices in their decision-making procedures. Generally, these trends show a dynamic landscape where flexibility and advancement are vital for success in the commercial actual estate industry.

Urban Centers to Check Out

Discovering urban facilities discloses a wealth of chances for capitalists in the commercial realty field. These dynamic places are usually characterized by high population thickness, durable economic activity, and diverse demographics, all adding to a vivid marketplace. Major cities such as New York, Los Angeles, and Chicago proceed to bring in substantial investment due to their well established frameworks and considerable transportation networks.

Additionally, cities like Austin and Seattle have emerged as tech hubs, driving need for business residential properties that sustain both workplace and retail establishments. The enhancing trend of remote work has also revitalized demand for flexible office in urban environments, satisfying businesses looking for versatile remedies.

Emerging Suburban Hotspots

A number find more info of suv areas across the nation are swiftly transforming into prime business hotspots, driven by a combination of population growth, financial growth, and shifting consumer choices. These arising suburban markets are increasingly appealing to capitalists and businesses alike, as they offer chances for development outside traditional urban centers.

Secret variables adding to this trend include the migration of families seeking cost effective real estate and boosted quality of life, alongside an influx of organizations brought in by reduced operating costs and beneficial zoning guidelines. commercial real estate for sale. Communities such as those in the Sun Belt area are particularly noteworthy, showcasing durable work development and a varied financial base

Furthermore, country areas are enhancing their infrastructure, including transport networks and public services, making them extra obtainable and enticing to both customers and services. This development is fostering vibrant business areas that cater to the demands of an expanding populace, which progressively favors ease and neighborhood services.

As these suburbs remain to progress, they present unique possibilities for financiers wanting to maximize arising patterns in retail, office, and mixed-use developments, inevitably reshaping the commercial property landscape across the country.

Key Consider Building Choice

When considering industrial homes for financial investment, a complete understanding of essential option elements is critical for guaranteeing lasting success. One of the key considerations is place. Properties located in high-traffic locations with excellent presence tend to attract even more consumers, thus raising the potential for earnings.

An additional crucial aspect is the property's condition and age. Purchasing properly maintained, modern buildings can decrease instant improvement costs and enhance occupant charm. In addition, the zoning regulations must line up with the meant usage of the building, ensuring compliance and operational viability.

Market fads likewise play a considerable role in property option. Looking into regional economic indications, such as task development and group shifts, can provide understandings into future need. Availability is another essential facet; residential properties close to visit this page significant transportation centers or highways enhance convenience for both services and clients.

Last but not least, comprehending the affordable landscape is crucial. Analyzing comparable homes in the location can help analyze potential rental revenue and occupancy prices - commercial real estate for sale. By considering these elements, capitalists can make informed choices, ultimately resulting in effective commercial residential property investments that satisfy their lasting objectives

Financing and Financial Investment Strategies

Navigating the complexities of funding and financial investment strategies is necessary for making the most of returns on industrial property investments. Financiers need to initially analyze their financial capacity and identify one of the most ideal funding alternatives, which might consist click this of traditional mortgages, personal equity, or crowdfunding platforms. Each choice provides special benefits and dangers that need to line up with the financier's objectives.

Next, it is vital to perform detailed marketing research to identify high-potential areas and property kinds. Recognizing neighborhood financial problems, market trends, and zoning regulations will educate financial investment choices and reduce risks. Investors must also take into consideration leveraging collaborations or submissions, enabling shared resources and minimized private exposure.

In enhancement, utilizing different investment approaches, such as value-add financial investments or long-term hold strategies, can boost returns. Value-add techniques concentrate on boosting a residential property's operational performance or physical look, while long-term holds gain from gratitude and secure money flow.

Last but not least, maintaining a varied portfolio can support against market volatility. By tactically combining different property types and markets, capitalists can enhance their risk-return account and achieve lasting development in the commercial actual estate sector.

Final Thought

Finally, determining prime business homes for sale requires a detailed understanding of present market patterns, with a focus on urban centers and emerging suv hotspots. Key aspects such as area, zoning regulations, and adaptability to advancing job versions play an essential role in residential property option. Utilizing calculated funding and financial investment techniques can boost the chance of an effective financial investment. By concentrating on these components, capitalists can browse the business actual estate landscape effectively.

Anthony Michael Hall Then & Now!

Anthony Michael Hall Then & Now! Kane Then & Now!

Kane Then & Now! Justine Bateman Then & Now!

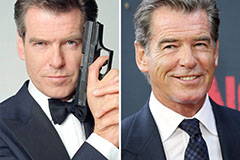

Justine Bateman Then & Now! Pierce Brosnan Then & Now!

Pierce Brosnan Then & Now! Terry Farrell Then & Now!

Terry Farrell Then & Now!